Achieve - Lead Product Designer

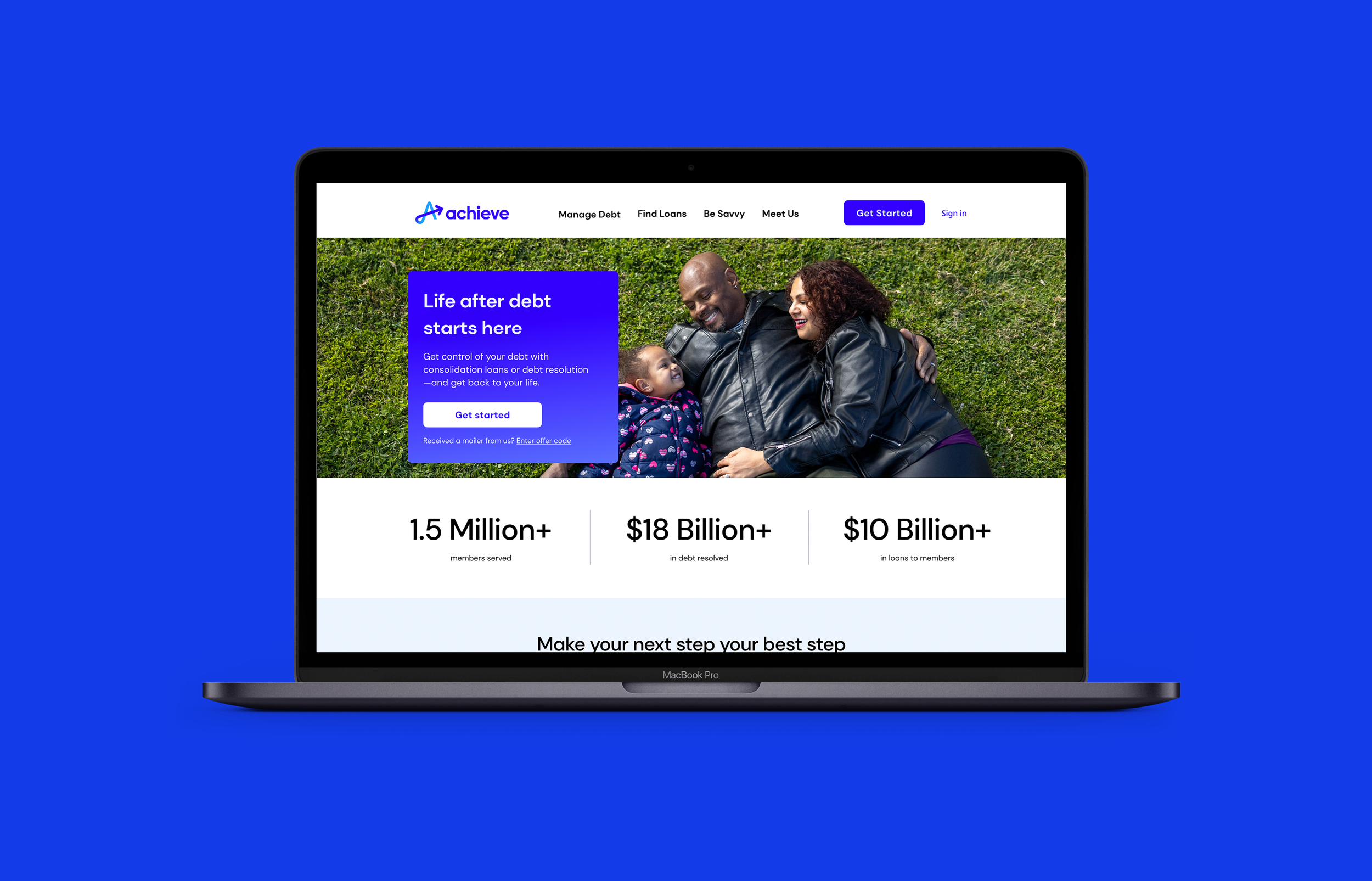

I led the end-to-end website design for a brand launch, driving 32% of all Achieve enrollments and 54.4% of total margin in 2023

Freedom Financial Network’s business units historically operated in silos, prioritizing transactions over holistic user engagement. This fragmented approach restricted users from accessing multiple financial solutions under one brand. The launch of a unified company name, Achieve, changed that, creating a connected experience for consumers. We brought all our business units into one brand–Home Loans, Personal Loans, Debt Resolution.

Context

As lead designer, I worked closely with a dedicated UX researcher and content strategist to build experiences that resonated with a newly expanded target audience of 123 million Americans managing unsecured debt. This collaboration was essential to launching scalable, human-centered solutions across four product lines, all tied to the company’s broader rebrand and digital transformation goals.

-

I initially co-led the project through the launch of Achieve, and since 2022, I’ve taken the lead on all design efforts—owning the end-to-end experience and guiding the evolution of the platform.

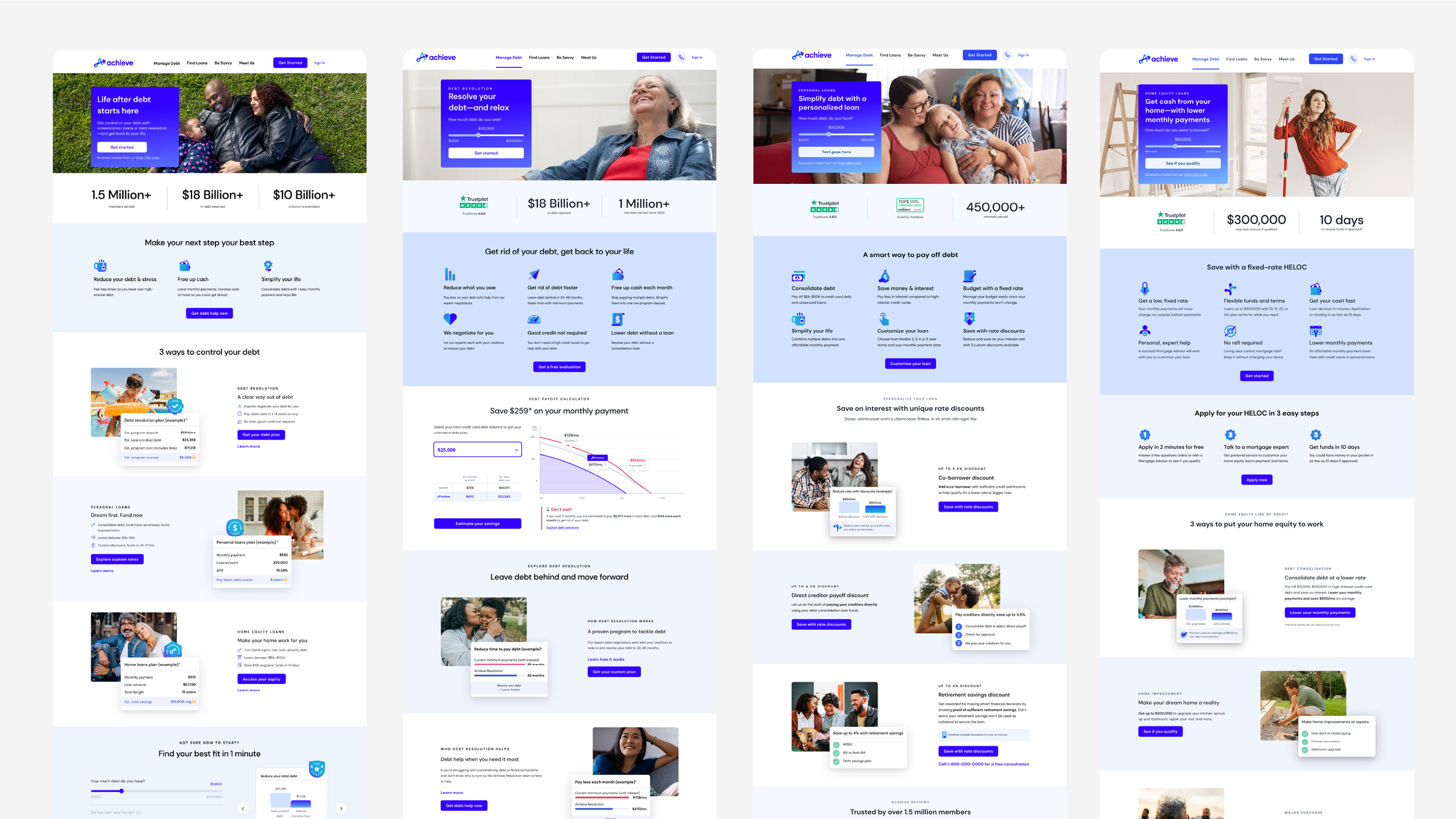

The scope of the work to include the homepage, global navigation, and key product pages. Our core team included 1 Principal PM, 5 engineers, 1 writer, 1 researcher, 2 designers (including myself), and close collaboration with Brand. -

Product & Brand Positioning: Ensure visitors immediately understand what Achieve is and how it can help with their financial situation.

Acquisition Goals: Increase conversion from homepage visitors to qualified leads and enrolled users.

Engagement Metrics: Improve average time on site, page views, return visits, and reduce bounce rate.

Satisfaction & Usability: Visitors should be able to accomplish their goals easily and rate the experience positively (via intercept surveys and NPS).

-

Primary: Everyday Americans facing financial stress—unsure where to turn for help, looking for debt solutions or financial improvement.

Secondary: Press, investors, job candidates, regulators, and strategic partners.

Process at a glance

-

Our design team led a five day design sprint. Through lightning talks, problem framing, “How Might We” exercises, affinity mapping, wireframe, fully functioning prototype in dev, and collaborative voting, we aligned on core user needs and early experience priorities.

-

The design adapts to each user’s intent—whether they’re ready to act or just exploring.

Clear CTAs guide action-ready users with ease.

Helpful, trust-building content supports those still deciding.

An interactive tool helps users assess their financial needs and find the right path forward.

-

Speak to user goals

Use phrases like “debt freedom,” “lower payments,” or “better credit” to connect with what matters most.Be supportive

Acknowledge financial stress with a calm, empathetic tone.Personalize the experience

Use interactive tools (like quizzes) to guide users based on their needs.Lead with connection, not conversion

Build trust first—then offer solutions.

Building user persona

Initial sketches

Navigation design/sketch

Homepage sprint wireframe

Enrollment flow wireframes

Final designs presented during sprint review

Final enrollment flow designs

Key design decisions

In response to stakeholder alignment challenges and the need to build consumer trust, we designed new conversion-focused pages grounded in credibility and user insight. Our cross-functional team—design, research, and content—collaborated to:

Lead with trust by crafting a compelling hero that surfaced real member stories and testimonials

Engagement with a purpose-built financial tool

Strengthen conversion through value propositions tied directly to user jobs-to-be-done

Align stakeholders early by embedding user research throughout and validating with prototype-led usability testing

Final designs

In 2023, we embarked on a major redesign grounded in our learnings from 2022, resulting in significant impact: overall site traffic grew to 1.15M unique visitors (+106%), 2.02M sessions (+198%), and 9.87M page views (+259%). Most notably, the redesigned experience drove 32% of all Achieve enrollments and 54.4% of total margin across the company for the year.

Results

📈 Overall Site Traffic 2022: 560k unique visitors, 680k+ sessions, 2.75MM page views.

📈 Overall Site Traffic 2023: 1,153,422 unique visitors (up 106%), 2,027,753 unique sessions (up 198%), and 9,877,866 page views (up 259%)

🔼 Enrollments & Total Margin in 23’: 32% of all Achieve Experience and 54.4% of all Achieve margin

🚥 Overall Site Traffic 2023 to 2024: 879% monthly traffic growth from Dec 2023 to Dec 2024 Yo, 582% total non-brand content page traffic 2023 to 2024 YoY.

📈 Year end growth also accompanied with a huge gain in flow start rate - 9% in Jan to 27% in Dec, 200% increase

Links

Achieve Home Designs

🔗 See it live

Achieve Home Loans Designs

🔗 See it live

Achieve Personal Loans Designs

🔗 See it live

Achieve Debt Resolution Designs

🔗 See it live

Achieve Accelerated Loan Designs

🔗 See it live

INFORMATION ARCHITECTURE

CONTENT / DESIGN STRATEGY

UI/UX DESIGN - WIREFRAME, GENERATIVE RESEARCH

ACCESSIBILITY + SEO

USER RESEARCH - CONCEPT TESTING

STAKEHOLDER + COLLABORATION

PRESENTATION