Achieve Personal Loans Landing Page Redesign

Page strategy, brand alignment, product intent alignment, design system updates, research & testing, cross-functional direction, and engineering handoff

Early test results showed a +19.3% lift in Direct-to-MP, moving from 47% to 56.1% within the first 4 weeks of the experiment.

01

-

Achieve’s Personal Loans page is the highest-performing landing page by traffic and engagement, with a strong 47% Direct-to-MP rate, but downstream conversion lagged.

Internal data showed users were entering the flow with loan intent, but lacked early trust, clarity, and confidence to continue into qualification.

This presented an opportunity to modernize the experience, close competitive gaps, and reinforce Achieve’s credibility in a regulated financial environment. -

Most users arrive with loan intent, but loan messaging was weak or unclear

Debt relief-first framing caused users to misunderstand Achieve’s broader offerings

Lack of legitimacy cues (trust badges, real member proof) created skepticism

Personal loans users with strong credit profiles weren’t seeing relevant solutions fast enough

Conversion fell at the point where users were forced to choose a product

Project Snapshot

02

-

Increase Direct-to-MP Rate by ~20%, from 47% to 57%

The core measurable goal of the project was to improve how many high-intent users entered the multi-product acquisition flow from the personal loans landing page. -

~$638k incremental marketing margin/year

Achieved by:

• Increasing qualified traffic entering the funnel

• Improving conversion efficiency without increasing paid spend

• Reducing friction and hesitation before checking their rate

• Every +0.2pp ER lift on head pages unlocks ~$2M incremental margin per quarter -

Increase Hero CTA interaction (more users checking their rate)

Increase scroll depth (engagement with “How it Works” and value props)

Increase trust element interaction (Trustpilot + social proof)

Improve clarity + comprehension (measured in usability testing)

Goal and Success Metrics

03

My Role & Responsibilities

Collaborated with:

Worked with Brand on voice and trust expression

Brand

PMs

Partnered with Product to define problems and KPIs

Engineers

Engineering to ensure feasibility + performance

Collaborated with PM + Data to define KPIs and A/B test structure

Data Science

Compliance

Compliance to meet regulatory standards

Defined the content ecosystem, module architecture, and page-level IA

Designed new modular approaches that now inform the broader acquisition ecosystem

Leveraged AI-assisted exploration to accelerate early IA and layout concepts

Facilitated alignment sessions and walkthroughs to ensure fidelity between design intent and implementation

What I Drove:

04

-

Clear comparison upfront

Competitors show rate ranges, terms, fees, and side-by-side benefits immediately—making decisions quick and low-effort.

Transparency builds trust

Key info like fees, eligibility, and funding timelines appears above the fold, helping users feel informed early.

Human visuals + scannable benefits

Customer imagery is paired with 5–7 quick benefits to make value easy to understand at a glance.

Clean layouts + focused CTAs

High-contrast sections, simple structure, and consistent CTA placement support fast scanning and clearer next steps. -

Key gaps in the existing personal loans page:

• Trust badges buried below primary content

• Low-intent headline and unclear hierarchy

• Over-emphasis on calculator

• Redundant value props lacking scannability

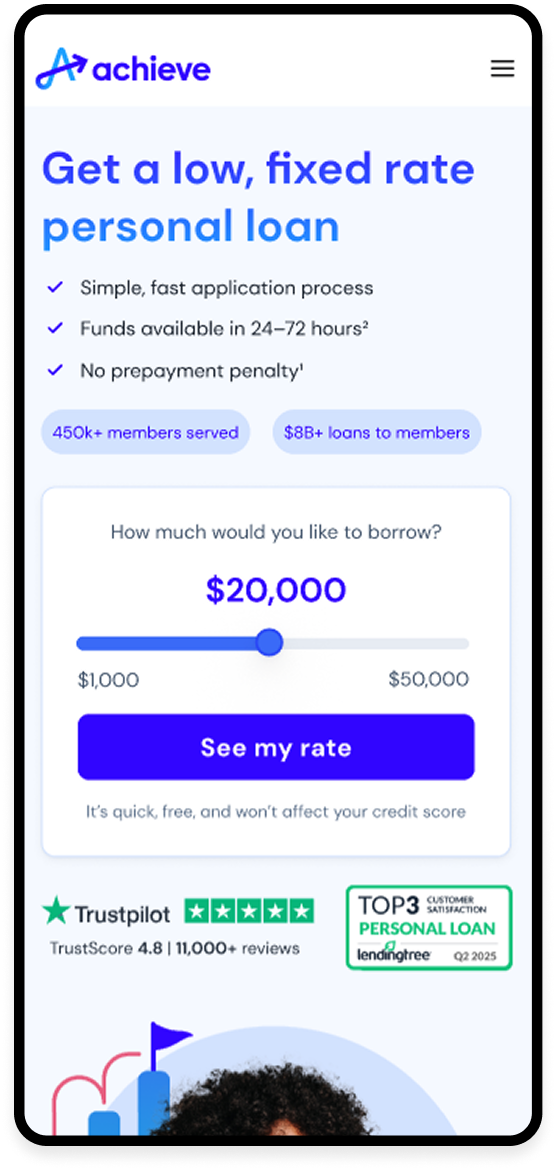

• Unoptimized mobile experience

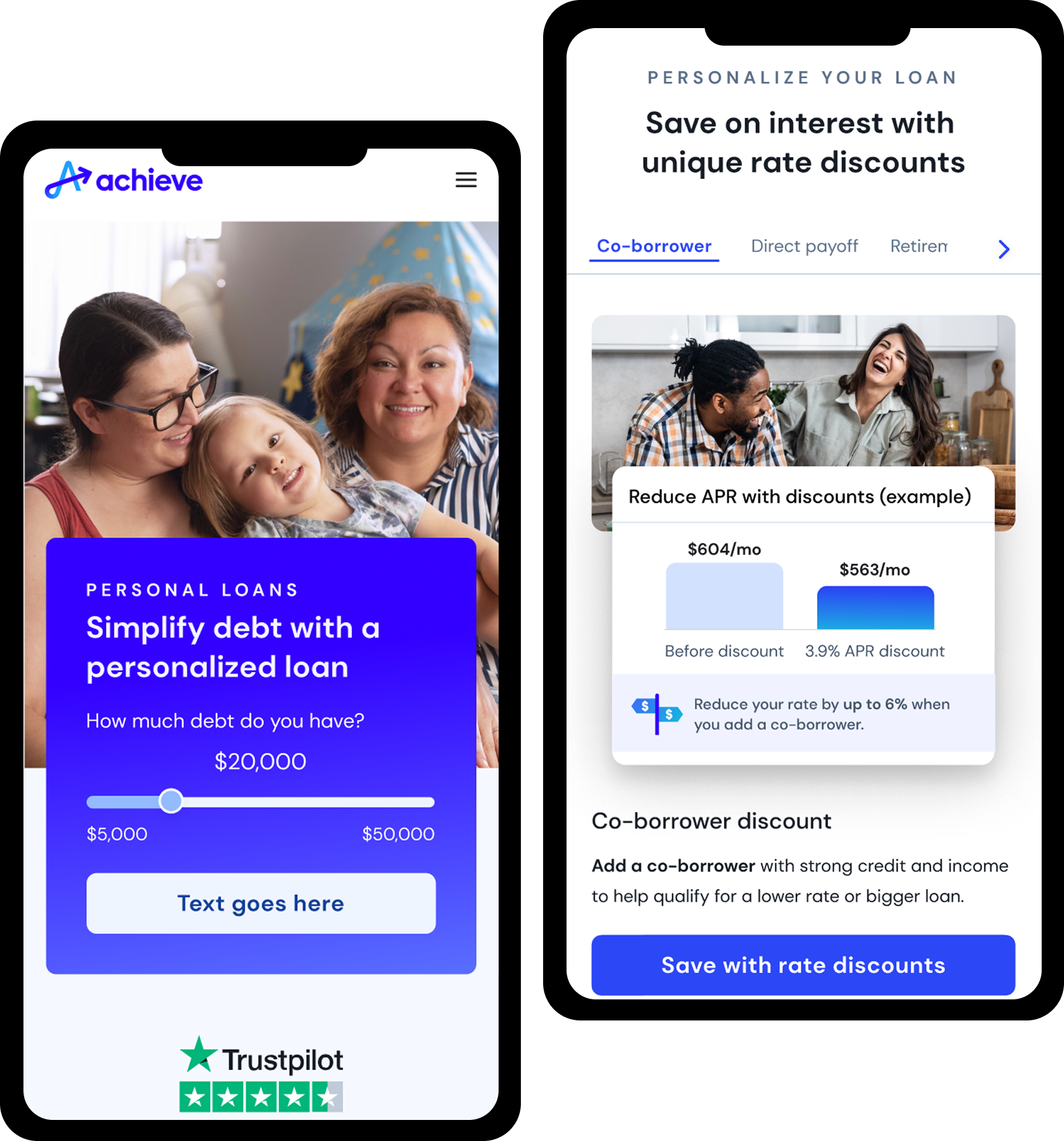

Primary audience:

• Borrowers under financial stress

• Users with relatively high credit who want to consolidate debt

• Visitors unsure which product is best

• People skeptical of online lenders who need reassurance -

Why I used AI:

• Generate fast structural variations (hero-first layouts, value-prop)

• Explore 4–6 information architectures quickly

• Test variations of calculators, sliders, and trust block placementsWhat I adopted:

• Trust markers repositioned into the hero

• Hero text simplified to high-intent PL messaging

• 3-step guide added right under hero

• Value props tightened to 3–4 high-intent benefits

Design Approach

05

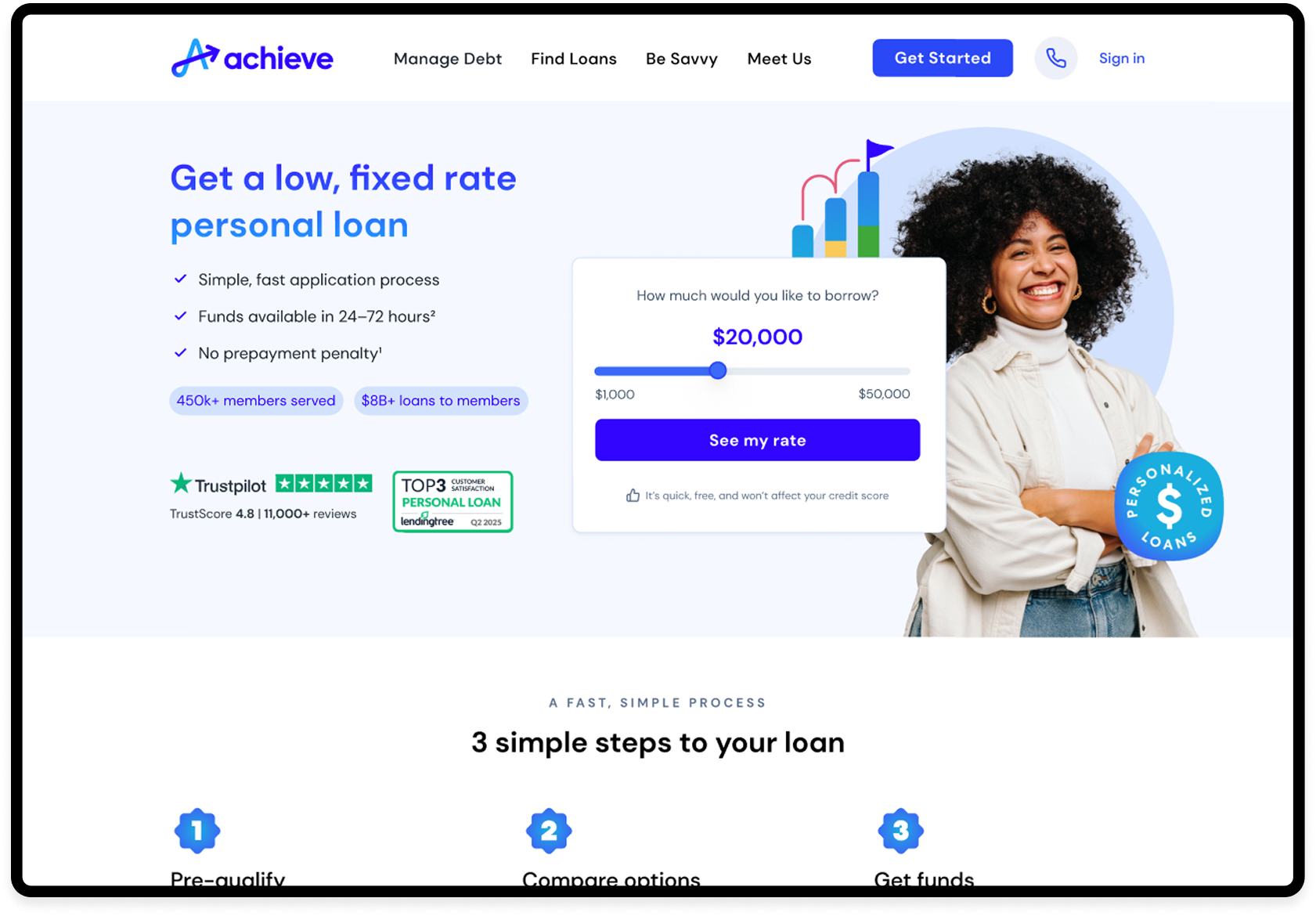

The Solution

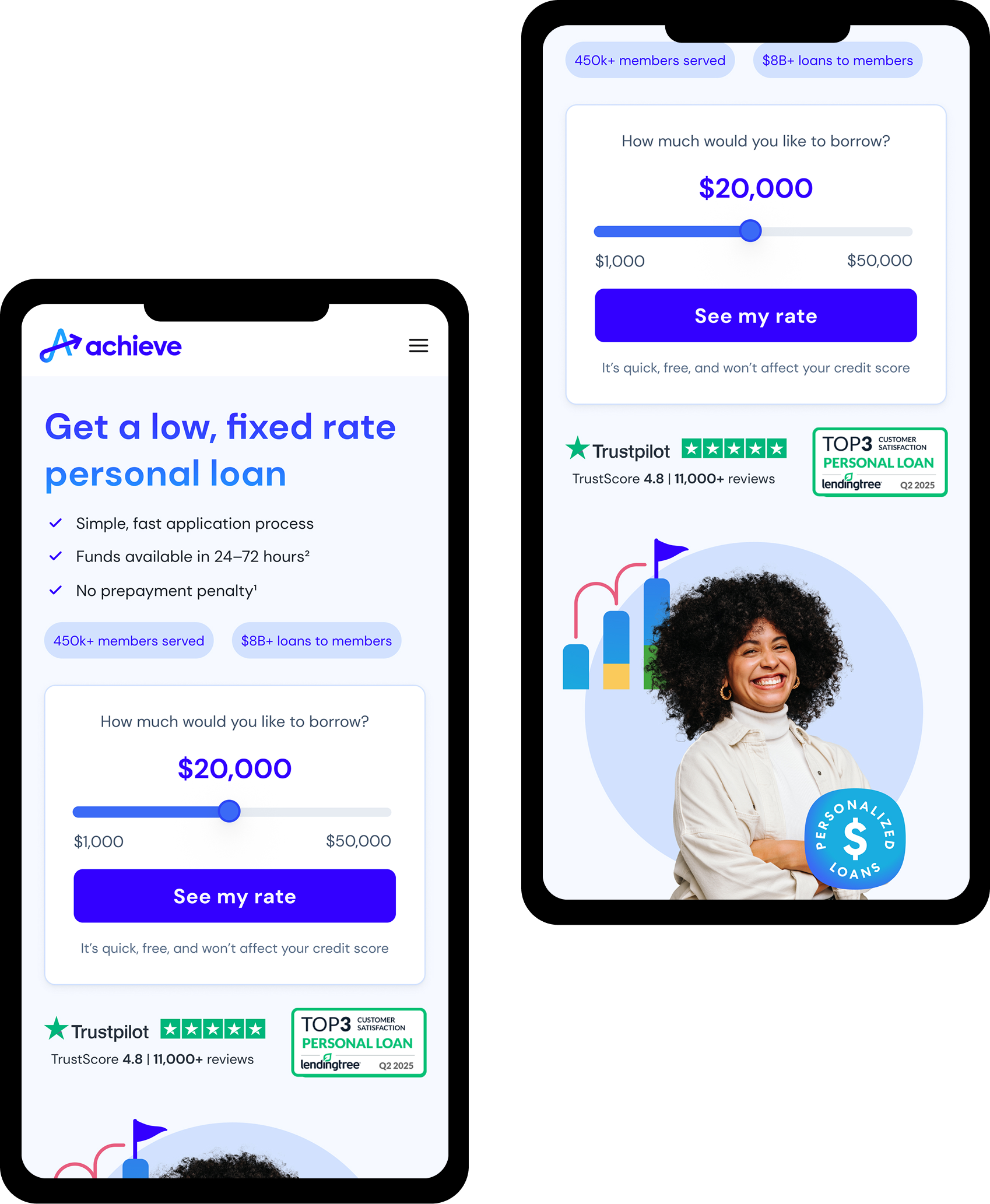

Clear, intent-driven hero messaging

Immediate visibility of key value props

Trust cues embedded directly into the hero

Interactive rate slider for fast exploration

Strong visual hierarchy with a high-contrast primary CTA

“See my rate” softens the tone a bit

For first time visitors, we added a line of copy to reassure the process is simple and has no impact to their credit profile

Above-the-Fold Transformation

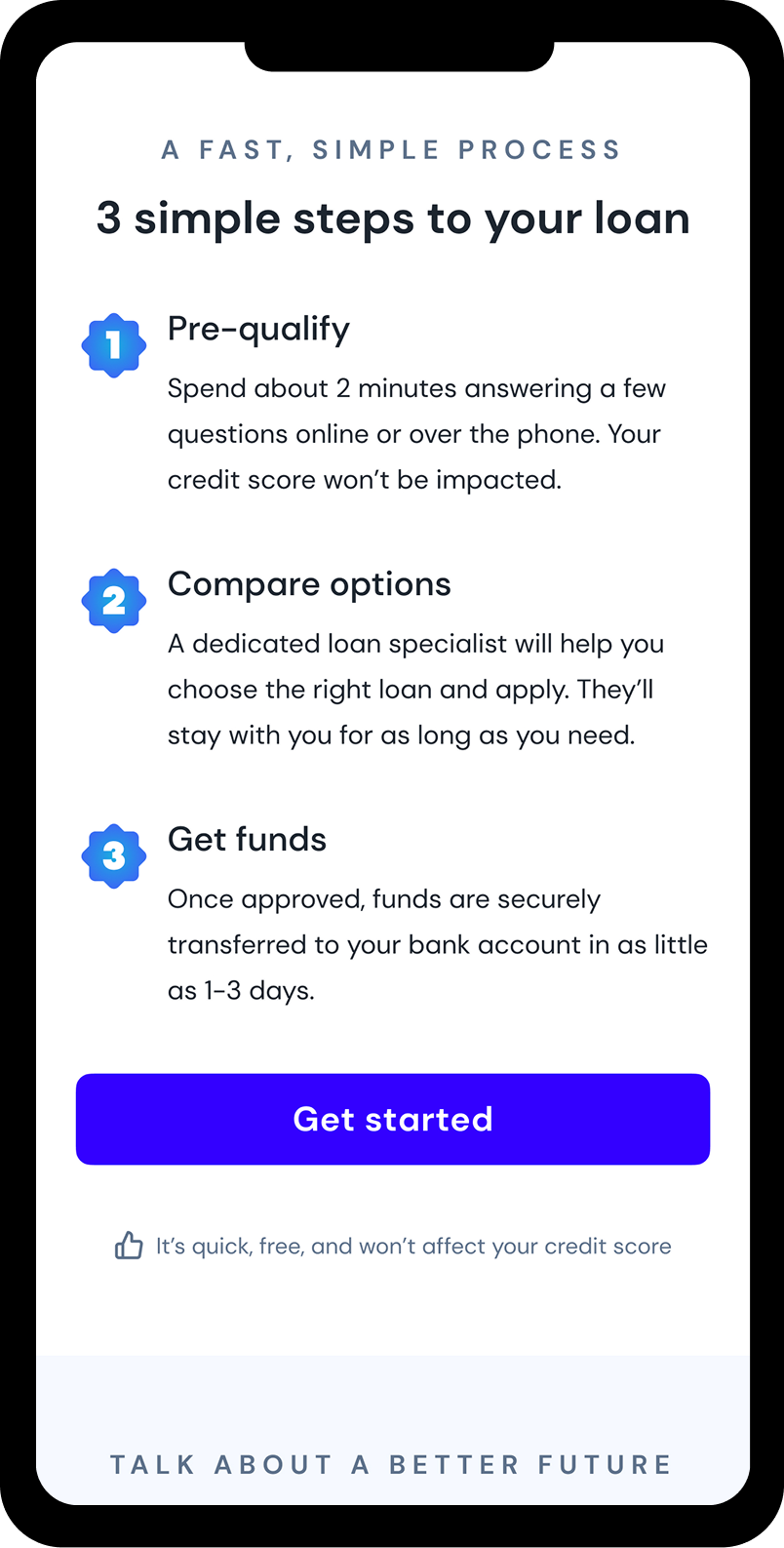

3-Step Loan Process

Pre-qualify

Compare options

Get funds quickly

Replaced dense text with a simple, scannable flow:

Clear explanation of loan benefits

Poof that Achieve is legitimate and trustworthy

Simple next step, not a complex decision tree

Rapid confirmation that they were in the right place

More transparency to less skepticism

To feel seen, not judged (distressed but credit-strong users)

Users needed:

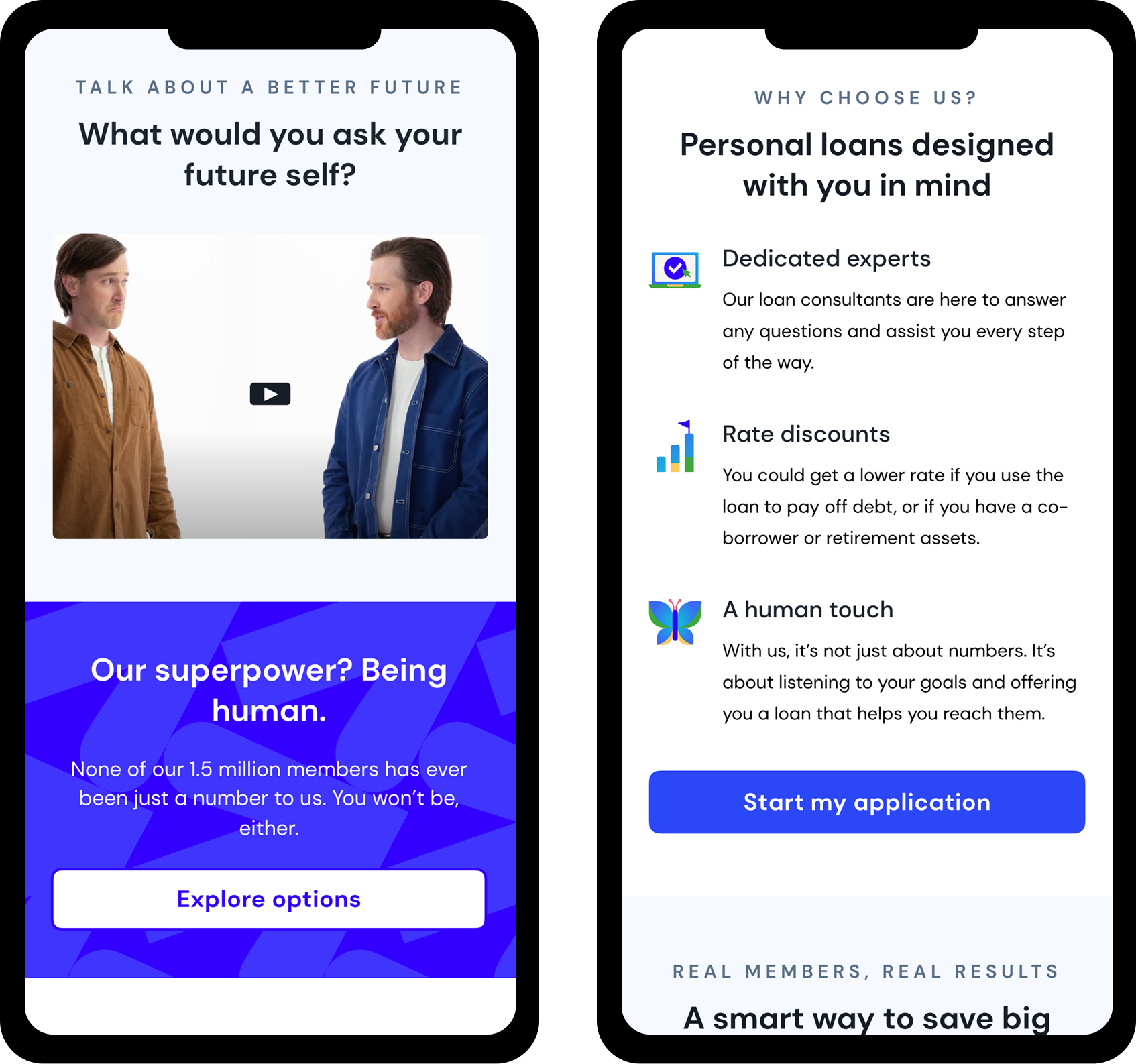

Video + Value Proposition Redesign

Human tone surfaced here with trust markers

Shifted from debt-relief-first messaging to loan-forward clarity aligned with user intent

Replaced generic photography with authentic HIW video to build emotional connection

Simplified content to reduce cognitive load for stressed users with strong credit profiles

Strengthened product-fit clarity so loan-seeking users immediately see relevant benefits

06

Final Designs

Enhanced readability

Balanced spacing

Trust cues higher in scroll

Stronger hierarchy

Mobile Design

Trust-based hero

Integrated rate slider

Refined value props

Simplified structure

Focused "How it Works" section

Clear CTAs

Desktop Design

07

Impact & Results

Early test results showed a +19.3% lift in Direct-to-MP, moving from 47% to 56.1% within the first 4 weeks of the experiment.

Primary KP

More high-intent users entered the qualification funnel

Reduced friction increased qualified traffic without additional marketing spend

Trust improvements led to lower bounce rates and deeper scroll engagement

~$150k margin in the first month

+12–18% increase in users reaching pre-qualification

Lower cost per qualified user due to more efficient self-selection

Improved traffic quality signals sent upstream to paid acquisition teams

Reduced drop-off at the hero by ~22%

Higher scroll engagement (+28%)